Britain’s Pacific trade agreement application: emerging British trade policy and Acuity’s assistance to clients with international business

Author: Henry Clarke

The United Kingdom is formally applying to join a trans-Pacific trade group whose members constitute about 8% of British exports (very roughly the equivalent of its exports to Germany). It is called the Comprehensive and Progressive Agreement for Trans-Pacific Partnership (CPATTP). This trade agreement succeeded the trade arrangement called the Tran-Pacific Partnership which the Trump administration withdrew the US from.

What is the CPATTP?

The CPATPP currently contains 11 medium sized and affluent states as members. These are Australia, Brunei, Canada, Chile, Japan, Malaysia, Mexico, New Zealand, Peru, Singapore and Vietnam. Perhaps Paddington Bear will now do a roaring trade in marmalade between the UK and Peru. The British government hopes the post-Trump US will also join CPATPP. If the US joins CPATPP it would enhance Anglo-American trade which in turn could be boosted by a specific Anglo-American trade deal. Observers note the new US administration is cautious of completing new trade deals as it – perhaps ironically – tries to rejuvenate the US economy.

Response from Critics

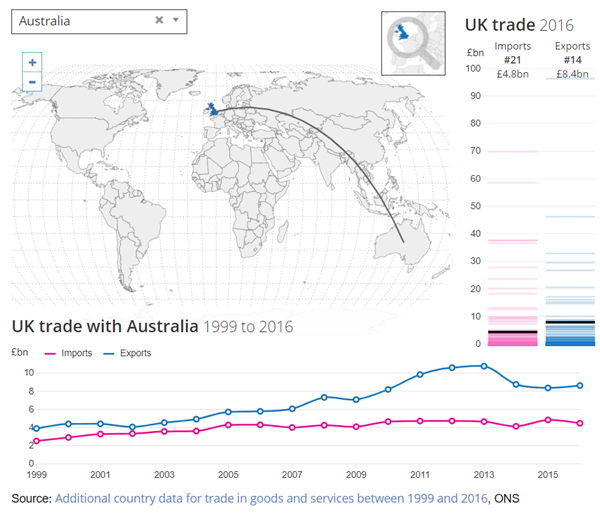

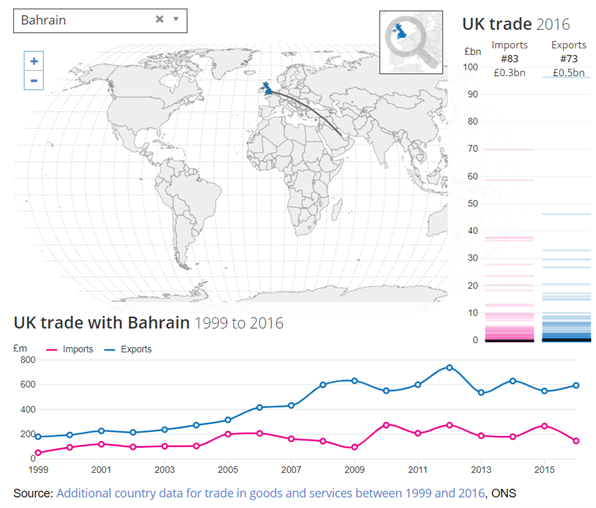

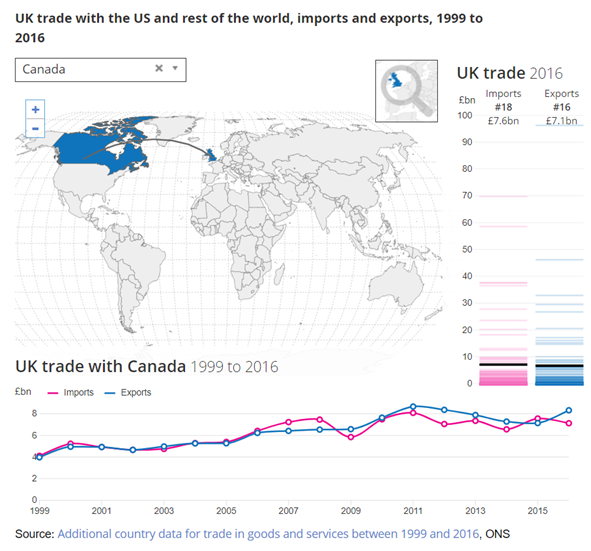

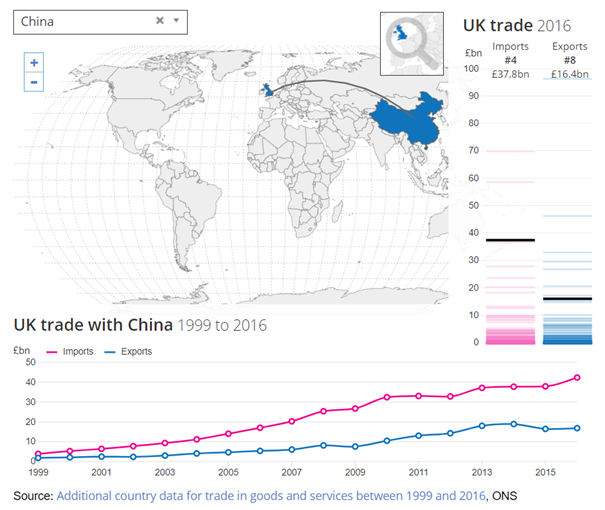

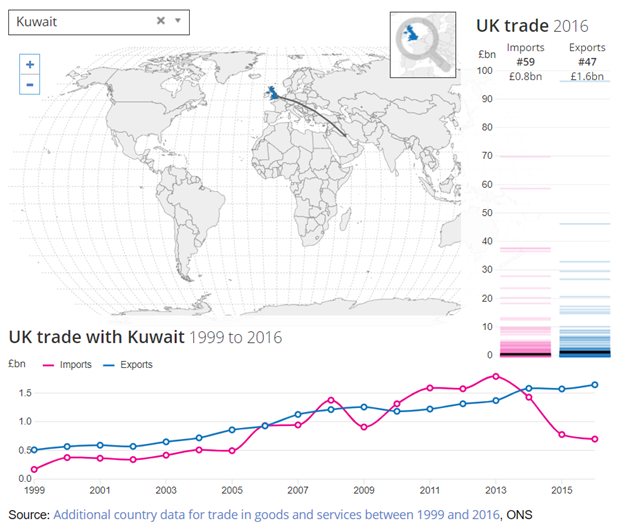

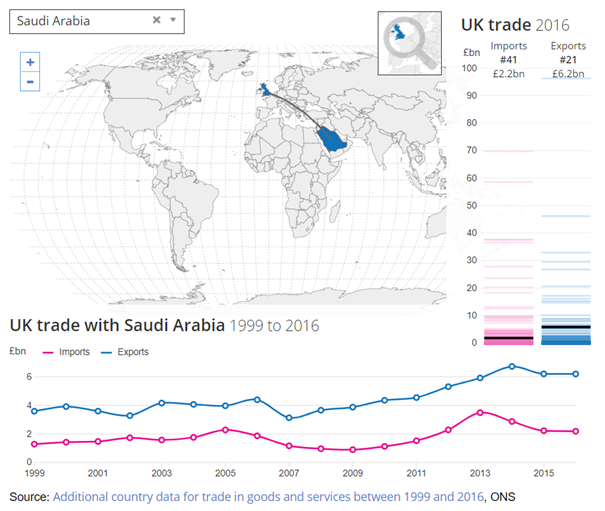

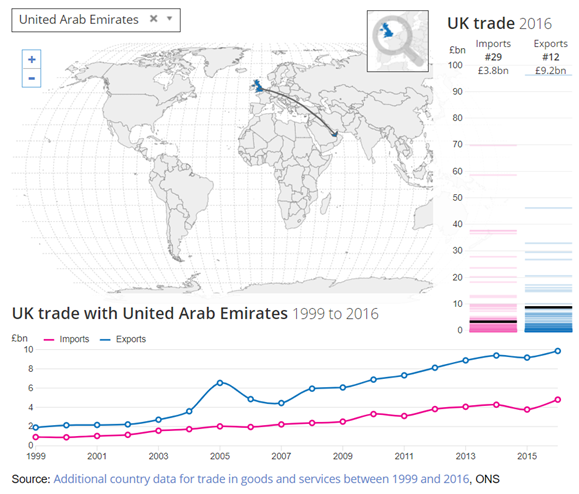

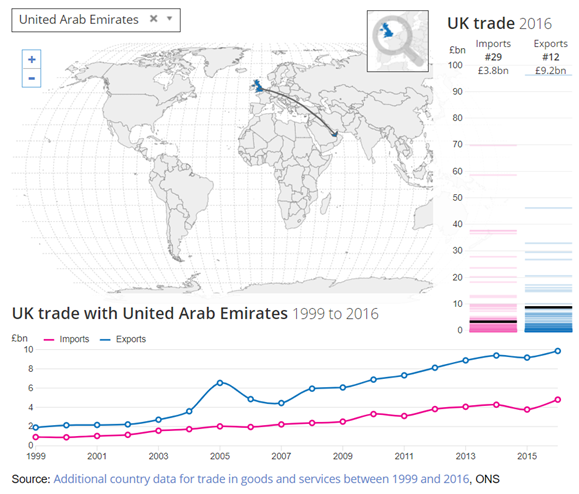

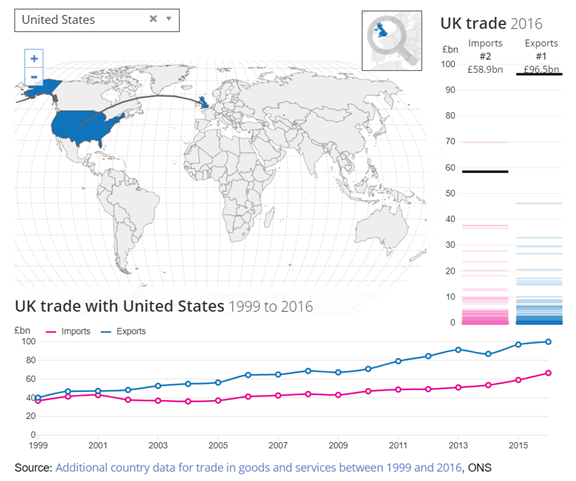

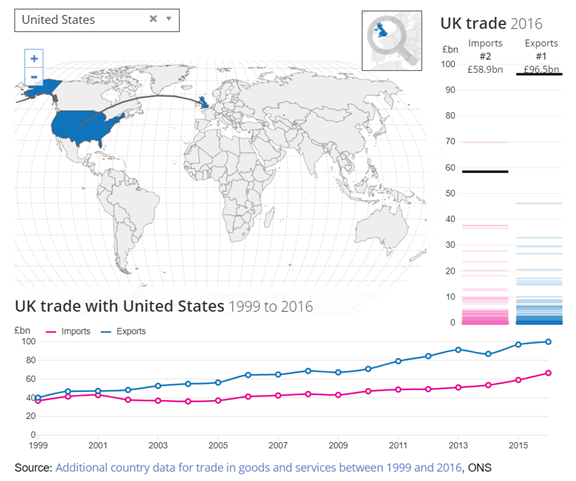

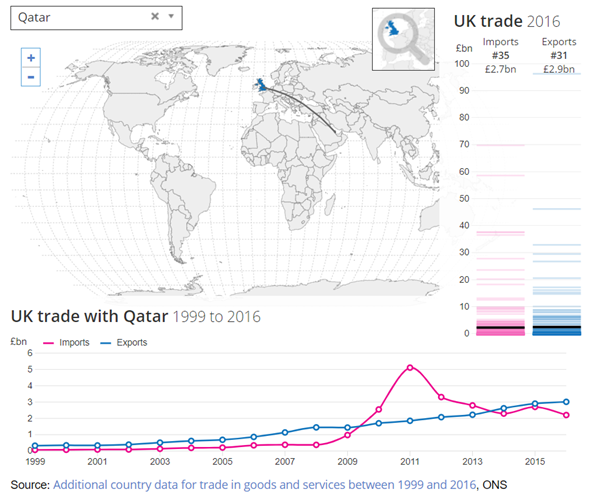

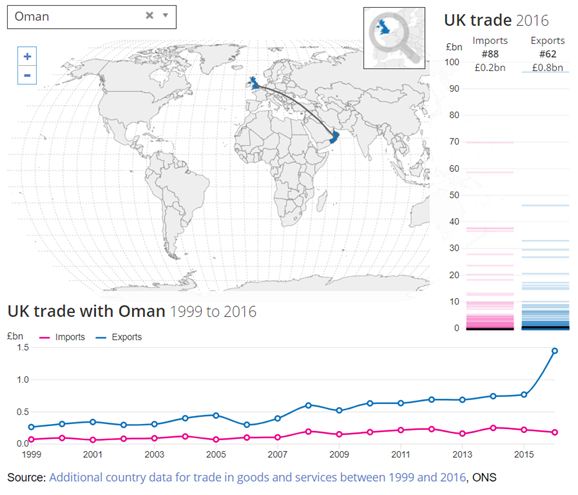

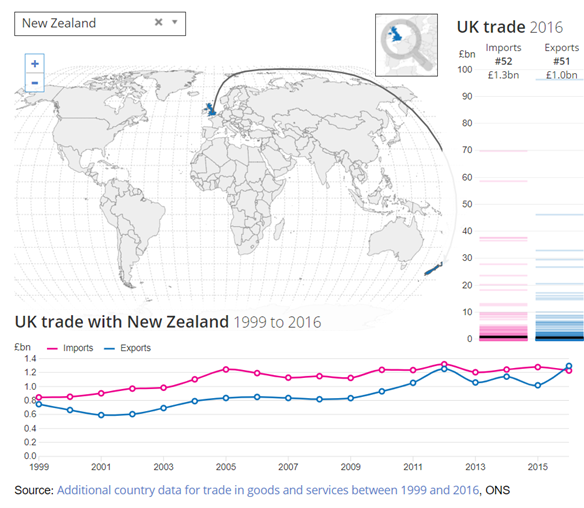

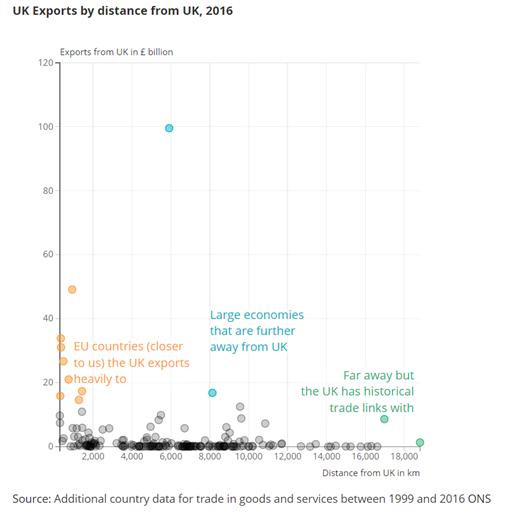

Critics consider the British application to be symbolic in nature. Critical studies indicate joining the agreement would only increase British GDP by an insignificant extent. This is partly because the membership of the agreement rings the Pacific, far from the UK on the shores of the Atlantic. Underpinning those views is the argument that trading with your neighbours is by far the most important priority. Figure 1 demonstrates this through the current British trade position. The top orange figure is Germany, where Britain exported £50 billion by value in 2016. The distance trading partners in green are Australia (more trade) and New Zealand (less trade). If one added the other target countries for UK trade diplomacy into trade agreements such as India, Australia, New Zealand and the Gulf, the addition to British GDP is still less than 1 percent in the long term. If one assumed the government did a trade deal with China, critics state the accumulated long-term growth in GDP from trade deals still does not increase beyond one percent. The Appendix gives recent British trade trends with these countries as background material. On the debit side, commentators point out that leaving the EU will result in a long-term foregone opportunity for trade with figures for this varying, but 4% of GDP has been cited.

View from the British Government

The British government sees it differently. The application shows Britain’s trade ambition. It is to be a champion of free trade. Britain will trade with willing countries. Many of those will be medium or small or with internationally exposed economies. According to the Financial Times, British trade with CPATPP members is £111 billion a year and has been growing at 8% annually since 2016 [1] when the Brexit referendum was held. Benefits of CPATPP membership are liberalizing digital trade, lower tariffs on luxury British items like whiskey and on complex goods like automobiles as well as liberalizing visas which may assist the service sector.

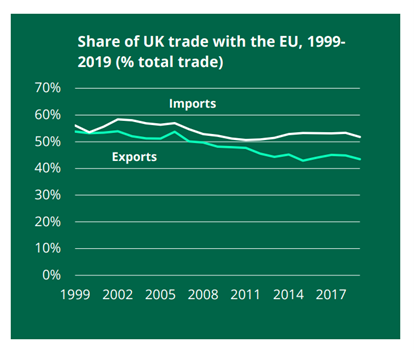

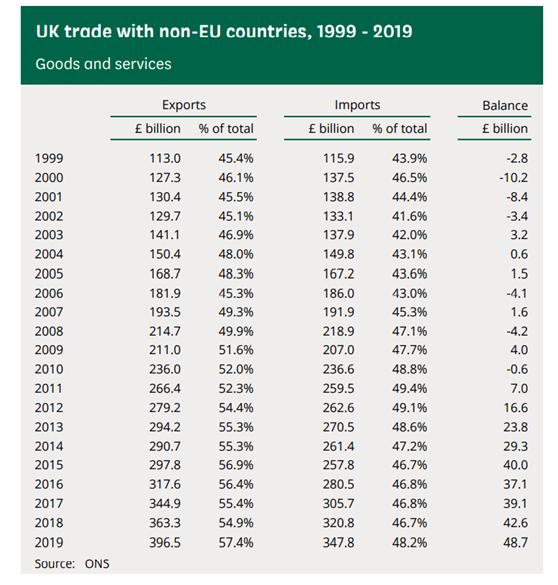

The EU has been declining as a proportion of British trade for some years now, even though it remains the biggest and most important component of that trade (see Figure 2). British trade with non-EU countries has been growing for years (see Figure 3). The UK is now finding its own trade policy that it hopes will suit its strong services sector as well as hopefully reinvigorate its manufacturing thereby positively impacting on its regional “levelling up” exercise. It is ambitious, but necessarily so following Brexit and considering longstanding regional economic disparities and the growth of regional nationalism.

In taking this approach the British government is noting a point often overlooked by non-historical economists in their criticism of the growth potential of non-EU trade for the UK. If not properly designed with real free trade in mind, trade agreements can divert trade as well as create trade and commerce. Joining the Common Market did create additional European trade for the UK over decades, but it did destroy and divert lots of historic British non-EU trade. It was a major factor in New Zealand and Australian economic restructuring and policy reformulation from the 1970s onwards. The Australian [2] reports that since the UK joined the EU Australian exports to the UK of beef have fallen 96 percent, sheep by 70 percent, rice by 92 percent, wheat by 99 percent, and sugar and butter by 100 percent. Despite the distance, those countries were major trade partners up to that point with a cultural affinity to each other that encouraged trade. It also meant that the British potential to develop free trade globally with willing partners was thus overlooked.

On the political left as well as on the right in British politics individual politicians spent years unfashionably trying to highlight this in the 20th century when European meant international and vice versa in the eyes of many Britons. The EU did develop free trade agreements around the world, but the process was slower than the British government would have liked with no real progress in certain sectors in which the UK would like to have had progress. However, the EU trade agreement network became widespread.

Post-Brexit Trade Agreements

Consequently, post-Brexit the British government is hoping the UK-EU trade agreement gives British business decent access to EU markets to sustain existing trade and exploit future economic growth in the Single Market whilst giving the UK the freedom to resurrect past, suppressed trade flows as well as ride the faster economic growth generally outside the EU. Firstly, it has preserved existing British trade access around the world via rolling over EU trade agreements with countries. Secondly, it is now seeking to enhance those terms through talks with willing partners.

These steps will play out in decades as we begin to see the results of this policy on the economic record for considered review. However, that means the impact of these trade agreements will be felt much earlier than that as trade trends develop. Below government trade policy lies the need for business to tap into the economic vigour of individual national markets with suitably well-run public goods and services.

It is the collective result of business activity that will create the economic record. In the 1780s the independence of the Thirteen Colonies led to despair and self-doubt in the UK. Yet the event led to an unexpected doubling of Anglo-American trade in the decade that followed. The historian JR Seeley wrote in 1883 [3] that the British Empire had been seemingly acquired in a fit of absentmindedness. The point of his comment was that a gradual, fitful process of activity by disparately located people who took the initiative without an overall strategic plan and unexpectedly created a political entity and trading system. In trade law terms, what was previously smuggled to avoid duties (or never traded) was now traded within an international political system underpinned by common law. Businesses can only build that economic trend if they are adept at international business.

How we can help

Acuity’s Trade Desk initiative monitors Britain’s trade agreement progress. It will host periodic events and publish occasional papers to assist businesses on the trade agreement developments. Just as importantly, to connect the strategic picture with the practical reality of market entry, Acuity will provide insights into the planning, design, and implementation of market entry whether that be for British business entering new markets or businesses looking to enter a dynamic British market. Despite the uncertainty and challenges of our times, we are currently in a time of trade change and opportunity with resulting business opportunity. Acuity is there to help with seizing such business opportunity in a successful, well-planned manner. We look forward to talking to you about your plans for market entry.

[1] ‘UK applies to join trans Pacific trade group’, G Parker and A Williams, 30 January 2021, www.ft.com

[2] Simon Birmingham, ‘Aiming for bullseye in trade talks with post-Brexit Britain’, The Australian, 31 January 2020

[3] J R Seeley, The Expansion of England, Macmillan 1883

Appendix – UK trade with selected countries